The Dow Jones Industrial Average has been declining the past few days and is now near 23,808.

Using my method of projecting price, 23,808 was projected to be the next target.

After that, the next targets were either 24,576 or 22,272.

24,576 was reached.

After 24,576 we would see either 25,344 or 23,040 next.

Although it's not impossible to reach 25,344 next, the probability given that as this is being posted the DJIA is trading at 23,843.53, 25,344 does not appear to be a very probable level to reach next. More probable is moving back through 23,808 and then 23,040.

26,624 represents probable stronger resistance to the upside.

Looking at the market from a long-term view - the DJIA is trading in a range that spans from 12,288 to 30,720.

The market has backed down several times after approaching the 29,000 level.

If we examine the DJIA in terms of the long-term represented as ranges we get:

1 - 12,288 - 14,336

2 - 14,336 - 16,384

3 - 16,384 - 18,432

4 - 18,432 - 20,480

5 - 20,480 - 22,528

6 - 22,528 - 24,576

7 - 24,576 - 26,624

8 - 26,624 - 28,672

9 - 28,672 - 30,720

Some points of interest to be aware of with the ranges.

The 52-week low was 18,213.65. That falls within the 3rd level.

The 3rd level tends to be a point where prices can accelerate higher. It can and does often serve as support in a falling market or resistance in a rising market.

The all-time DJIA high was 29,568.57 which was within the 9th level. The 9th level is a level where in a rising market you would expect stiffer resistance to probably form. At DJIA above 30,720 at some future point, 30,720 should probably represent some future support, but is presently resistance.

Recently a temporary peak in the DJIA formed near 24,700 which was slightly higher than the top of the 6th level top of 24,576.

24,700 is within the lower portion of the 7th level. The 7th level is a more ambiguous level. However, the fact that price failed to hold within the 7th level and slid to well within the 7th level is not suggestive of strong upward momentum in the DJIA.

Should the DJIA slide back to 23,040 then that places 22,528 within view which is support between the 5th and 6th levels.

Beyond or below 22,528 we would really just be speculating.

However, it would not be completely surprising to see a retest of the 3rd level from anywhere below 18,432 to 16,384.

Based on previous recession-level stock market declines a 40 - 50% decline is fairly typical. Given the all-time high of 29,568.57 a 40% decline would take the DJIA to 17,741.14. A 50% decline would move the DJIA to 14,784.28.

17,741.14 is solidly within the 3rd level between 16,384 and 18,432.

14,784.28 is near the bottom of the 2nd level. You shouldn't be surprised that a slightly greater than 50% decline could occur given that the current economic situation in the United States is more akin to a depression rather than a recession.

While this could potentially be a relatively short (2-3 years) and steep decline before the greatest bull market opportunity of our lifetimes, the market will have to decline sharply enough to destroy whatever optimism remains in order to shake out the longs and create the conditions necessary for the market to reverse higher on a longer term basis.

Over time I will go into a deeper explanation of where the numbers for the various DJIA levels came from and the ideas that stand behind them.

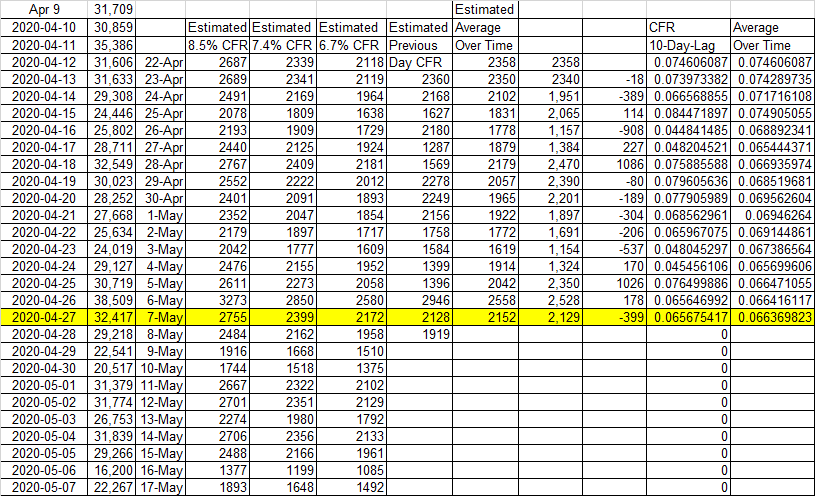

Current U.S. COVID-19 Deaths for 5-7-20 = 2,129.

The Case Fatality Rate (CFR) has been slowly settling down to just under 6.7%.

You may notice that if by using the previous day's CFR multiplied by new cases from 10 days ago, you will end up with a number, on average, that is very close to actual deaths over time.

From 23 April to 7 May actual COVID-19 U.S. Deaths were 29,031.

From 23 April to 7 May estimated using average CFR as it changed over time estimated 30,118.

For the same period using the previous day CFR we get an estimate of 29,086.

Using the 6.7% CFR for the same period gives an estimate of 29,401.

Over time, using the previous day's CFR, has given an estimate that - over time - has been very close to the actual total deaths.

While more complex models such as University of Washington's Institute for Health Metrics and Evaluation (IHME) have bounced around somewhat, my much simpler estimate(s) do a good job looking 10 days into the future.

On the other hand, if you want a model that ...

I recently published a larger post about estimated U.S. COVID-19 deaths.

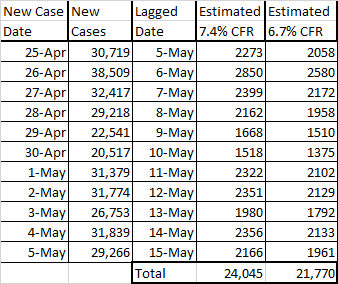

Below is a table showing estimated deaths from today - 5-5-20 to 5-15-20.

Today's deaths total was 2,350 according to Worldometers.

https://www.worldometers.info/coronavirus/#countries

That total was above the 7.4% Case Fatality Rate of 2,273 but under the (not shown) 8.5% level of 2,611.

Given that U.S. new cases is still above 20K per day, and that the CFR is dropping slowly, it appears probable that U.S. COVID-19 deaths will reach 100K by the 3rd or 4th week of May.

Note that tomorrow (May 6th) COVID-19 Deaths in the U.S. could be pretty high given they are based on 38,509 cases from April 26th. Nothing would make me happier to be wrong about this and the numbers come in much lower, but I'm afraid that will not be the case.

COVID-19 and Lockdown Based on Proportion

Currently, according to the New York Times, there are 18 of the 49 contiguous U.S. states plus the District of Columbia where COVID-19 cases are increasing.

There are 20 cases where numbers are roughly the same.

There are 11 states where cases are decreasing.

I have removed Alaska and Hawaii as they are not in the contiguous U.S. and therefore travel to either state is more difficult, decreasing the risk of spread. This idea is reinforced by the fact that both states show a fairly sharp decline in cases.

Looking at these numbers as percentages we get:

Increasing = 18/49 = 0.36437

Same = 20/49 = 0.408163

Decreasing = 11/49 = 0.22449

So roughly, increasing 36%, same, 41%, and decreasing 22% with 1% left off because of rounding.

Perhaps the most well-known proportion is the Golden Mean or 0.618 / 0.382 or 61.8% / 38.2%. People attribute all kinds of significance to the Golden Mean or Golden Measure. Some say it is a proportion that is pleasing to the eye. Others look at it as a way that ...